Why Security Incidents Matter: The Stakes for Card Shops and Collectors

- Dr. Mardis

- 1 day ago

- 5 min read

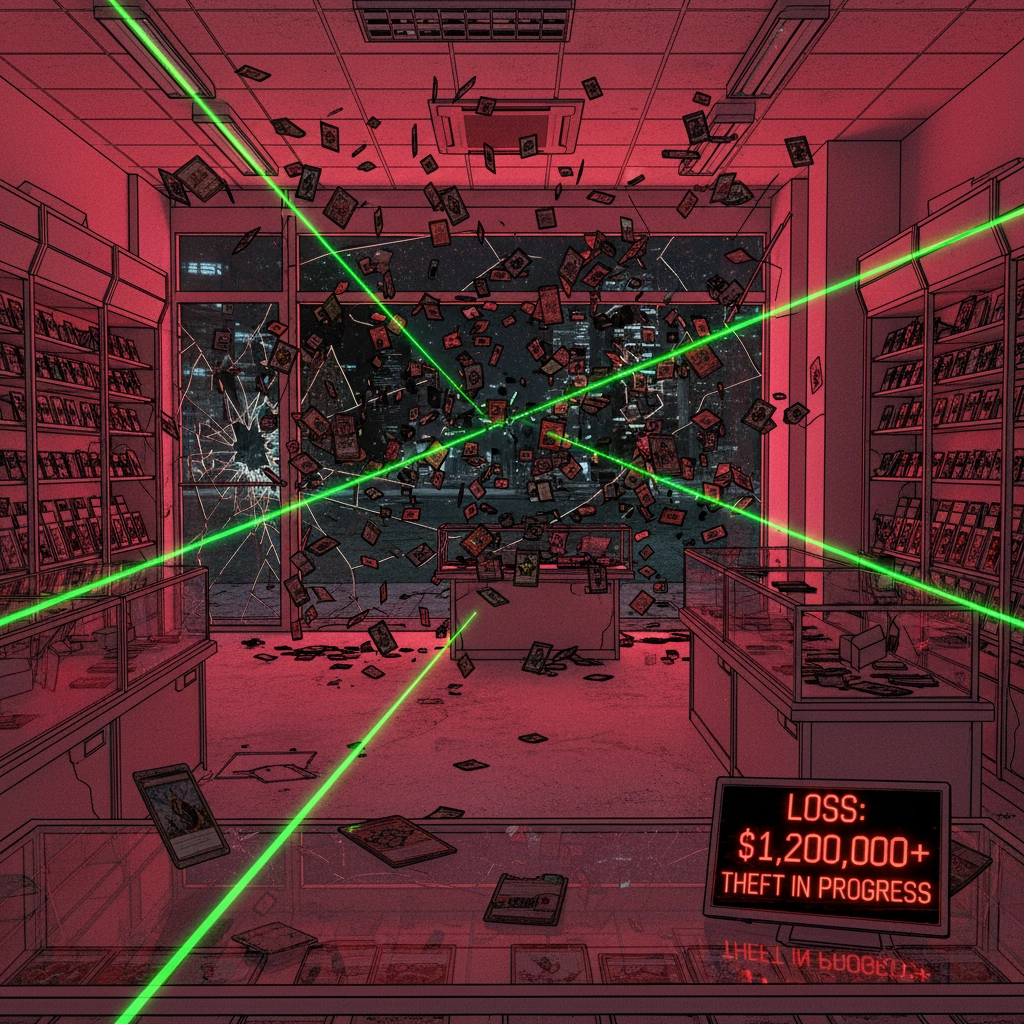

The collectibles world isn't immune to crime. Card shops face break-ins, collectors get robbed at shows, and online scams target high-value transactions daily. These aren't just minor inconveniences: they're devastating events that ripple through our entire community.

When security incidents happen, everyone pays the price. Shop owners lose inventory and customers. Collectors lose prized possessions and peace of mind. The hobby itself suffers as fear replaces excitement at shows and online marketplaces.

The Financial Hit Never Stops

Money walks out the door fast during security incidents. At the Philadelphia Sports Card & Memorabilia Show in December, thieves made off with two high-end unopened boxes during show hours. Gone in minutes. Thousands of dollars vanished.

But that's just the beginning. The financial bleeding continues long after the initial theft:

Legal fees pile up pursuing justice

Insurance claims mean higher premiums

Additional security measures cost money

Lost sales from scared customers

Time spent on police reports instead of running the business

For collectors, the math gets ugly quick. That stolen vintage rookie card worth $5,000? Insurance might cover market value, but finding another mint condition copy could cost double. Emotional value? Irreplaceable.

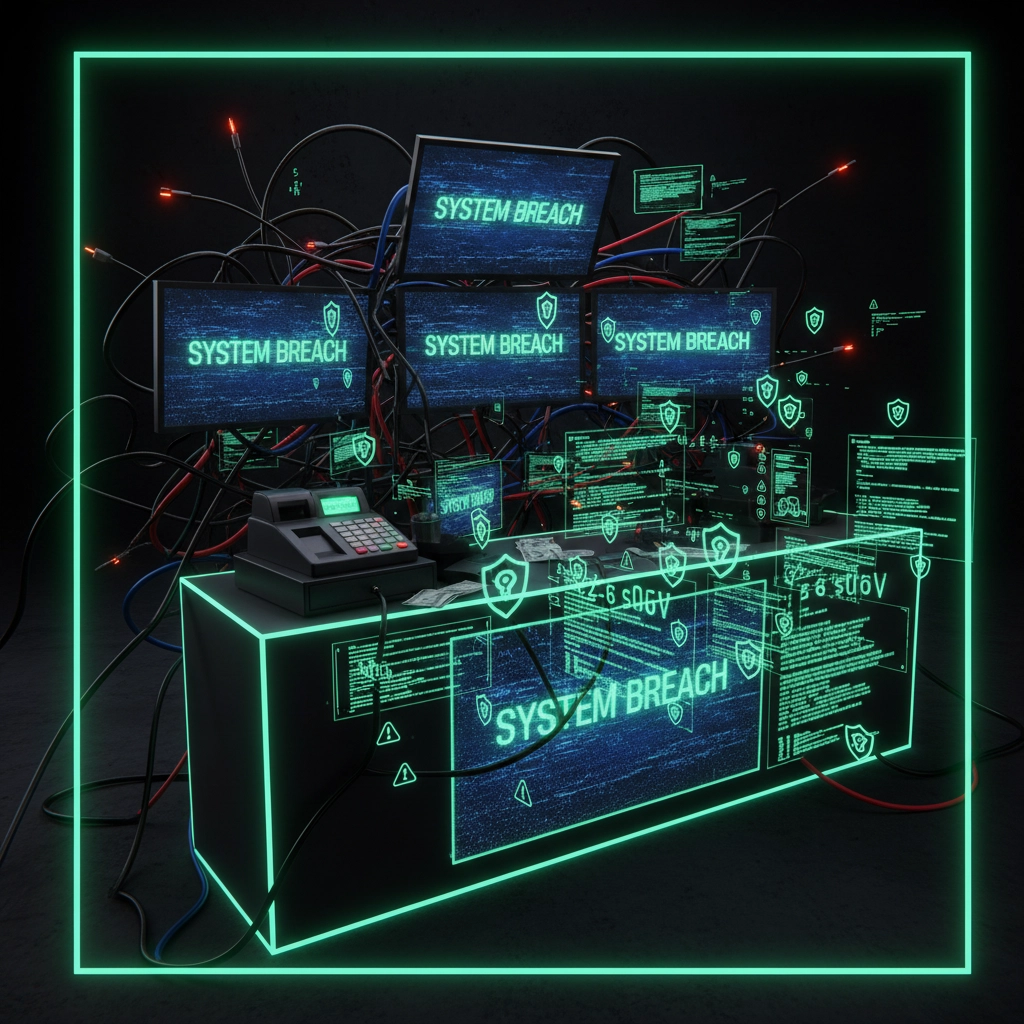

Cybersecurity breaches hit different but hurt just as much. When hackers infiltrate a shop's payment system, customers' financial information becomes a weapon. Fraudulent charges, drained bank accounts, and identity theft follow. The Payment Card Industry can impose fines on breached businesses. Research shows attacked firms lose 1.1% of market value and see sales growth drop by 3.2 percentage points.

Trust Evaporates Overnight

The collectibles market runs on trust. Collectors need to believe shops will protect their purchases and personal information. Dealers rely on customers feeling safe at shows and comfortable making big purchases.

One security incident destroys years of relationship building. When that Philadelphia show collector got followed to dinner and robbed in the restaurant parking lot, it sent shockwaves through the community. Suddenly, everyone questioned their safety at shows.

Customer data breaches create lasting damage. After Target's 2013 breach cost them $162 million in immediate expenses, holiday sales plummeted and customer loyalty took years to rebuild. Collectors start questioning every transaction: "Is my credit card safe here? Will my address get leaked to criminals?"

Operations Grind to a Halt

Security incidents force immediate operational changes that hurt everyone involved. After recent thefts, dealers now hire private security guards, bring safes to shows, and install personal cameras at their booths. The Philadelphia show already employs multiple undercover officers, armed guards, and uniformed police: yet thefts still happen.

These defensive measures cost money and create friction. Customers face longer checkout times due to enhanced verification procedures. Popular dealers become harder to approach with security personnel hovering nearby. The friendly, community atmosphere that makes card shows special gets replaced by suspicion and caution.

Online operations shut down entirely during cyber incidents. Hacked shops halt sales to contain breaches, leaving customers unable to complete purchases or access their accounts. Orders get delayed. Customer service gets overwhelmed. The ripple effects touch every aspect of the business.

Personal Information Becomes Public

Modern card shops collect extensive customer data: names, addresses, phone numbers, purchase histories, and payment information. When hackers breach these systems, intimate details about collectors' habits and spending become commodities on the dark web.

The violation feels personal because it is. Criminals use leaked information to craft convincing phishing emails impersonating trusted shops. They call collectors pretending to verify "suspicious transactions" while fishing for more details. Social engineering attacks become surgical strikes against specific individuals.

Identity theft follows naturally. With enough personal information, criminals open credit cards, take out loans, and wreck credit scores. Victims spend months or years unwinding the damage, all while feeling violated and exposed.

The Industry Reputation Takes a Hit

One shop's security failure reflects poorly on everyone in the business. When hackers successfully infiltrate a popular online card retailer, collectors start questioning the entire industry's cybersecurity practices. "If this trusted shop got hacked, who else might be vulnerable?"

The interconnected nature of the hobby amplifies these concerns. Shops use similar payment processors, attend the same trade shows, and share vendor relationships. A breach at one business often exposes systematic vulnerabilities affecting multiple companies.

Recent research found 97% of the top 100 US retailers experienced third-party data breaches in the past year. For an industry built on trust and personal relationships, these statistics are devastating. Each incident makes collectors more suspicious of legitimate businesses trying to serve them honestly.

Insurance Becomes Essential but Expensive

High-profile thefts drive collectors to seek insurance protection they never considered before. Insurance companies report quote volume spikes following major security incidents as collectors recognize these events as wake-up calls.

Many new insurance customers have personally experienced losses or know someone who has. Fire and theft rank as the most common causes of collection damage, with valuable cards now targeted like jewelry and artwork.

But insurance comes with complications. Proving the condition and authenticity of stolen cards requires extensive documentation many collectors lack. Market value fluctuations mean yesterday's coverage might not replace today's losses. Premiums reflect the increased risk, making protection expensive for serious collectors.

The Emotional Toll Runs Deep

Beyond financial losses, security incidents inflict emotional damage that's harder to quantify. Collectors describe feeling violated after thefts, especially when criminals target their homes or personal vehicles. The sanctuary of their collection becomes a crime scene.

Show attendance drops after publicized incidents as collectors choose safety over their hobby. Veterans who've attended shows for decades suddenly feel vulnerable. New collectors avoid events entirely, robbing the community of fresh enthusiasm and growth.

Shop owners carry guilt when customers become victims. They question every security decision and struggle with balancing accessibility against protection. The joy of connecting collectors with their dream cards gets overshadowed by constant vigilance against potential threats.

Reporting Gaps Make Everything Worse

Most security incidents in the collectibles world go unreported or under-reported. Shop owners worry about reputation damage from publicizing breaches. Collectors often don't report thefts to avoid insurance complications or simply accept their losses.

This silence amplifies every problem. Criminal patterns go unrecognized when incidents aren't shared. New shops repeat security mistakes because they never heard about previous breaches. Collectors remain vulnerable to known scam tactics because warnings don't circulate effectively.

Without comprehensive reporting and information sharing, the entire community remains in the dark about evolving threats. Each business and collector faces dangers alone instead of benefiting from collective knowledge and experience.

The Path Forward Requires Collective Action

Security incidents matter because they threaten the foundation of our hobby: trust, community, and the joy of collecting. Every theft, breach, and scam makes the entire experience less enjoyable and more risky for everyone involved.

The stakes are real and growing. As card values increase and more transactions move online, criminals see bigger opportunities. Without improved security practices, comprehensive incident reporting, and community-wide awareness, these problems will only get worse.

The collectibles community needs to acknowledge that security isn't someone else's problem: it's everyone's responsibility. Shops must invest in protection measures, collectors need to stay vigilant, and the entire industry should share information about emerging threats.

The hobby we love depends on creating an environment where collecting remains fun, safe, and secure for everyone involved. That starts with understanding why security incidents matter and taking action before the next one happens.

Comments